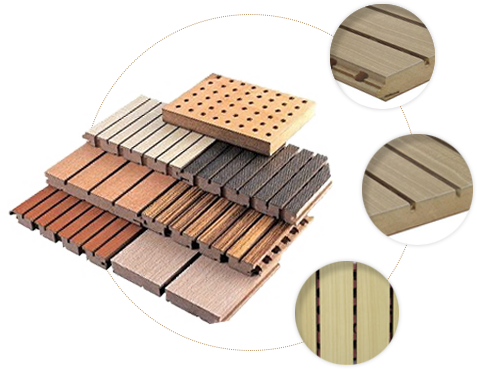

是一家致力于研究、开发、生产和销售节能环保吸音装饰材料的厂家。公司主要产品有:吸音板、 、木质隔音板、陶铝吸音板、生态木吸音板、聚酯纤维吸音板、聚酯纤维隔音板、布艺吸音板、各类环保吸音板和防火吸音板。

成立于1998年,位于全国的物流商贸基地─山东省临沂市。公司聚集了业内高、精、尖技术人才,引进国外先进的生产设备和工艺,开发生产各种吸音装饰艺术板。是目前华北地区规模大的声学装饰材料及木质装饰材料生产企业。

企业秉承用户至上的经营理念,本着以质量求生存、以信誉促发展的经营宗旨,致力于打造中国大的吸音材料研发生产基地。企业主要生产环保木质吸音装饰板、木丝吸音装饰板、烤漆吸音板、布艺吸音材料、聚酯纤维吸音板、陶铝吸音板等各种防火防潮吸音板产品。可满足客户不同风格和层次的吸音装饰要求。

竭诚欢迎国内外客商洽谈合作,共同发展。

是一家致力于研究、开发、生产和销售节能环保吸音装饰材料的厂家。公司主要产品有:吸音板、 、木质隔音板、陶铝吸音板、生态木吸音板、聚酯纤维吸音板、聚酯纤维隔音板、布艺吸音板、各类环保吸音板和防火吸音板。

成立于1998年,位于全国的物流商贸基地─山东省临沂市。公司聚集了业内高、精、尖技术人才,引进国外先进的生产设备和工艺,开发生产各种吸音装饰艺术板。是目前华北地区规模大的声学装饰材料及木质装饰材料生产企业。

企业秉承用户至上的经营理念,本着以质量求生存、以信誉促发展的经营宗旨,致力于打造中国大的吸音材料研发生产基地。企业主要生产环保木质吸音装饰板、木丝吸音装饰板、烤漆吸音板、布艺吸音材料、聚酯纤维吸音板、陶铝吸音板等各种防火防潮吸音板产品。可满足客户不同风格和层次的吸音装饰要求。

竭诚欢迎国内外客商洽谈合作,共同发展。

多年诚信经营,值得信赖

WE HAVE BEEN OPERATING IN GOOD FAITH FOR MANY YEARS AND ARE TRUSTWORTHY

公司建厂多年,生产经验丰富,值得信赖

公司建厂多年,生产经验丰富,值得信赖

公司获得新老客户认可;如今已成为较大型的吸音板供应商。

公司获得新老客户认可;如今已成为较大型的吸音板供应商。

严格把关细节确保每一件产品质量

STRICTLY CONTROL THE DETAILS TO ENSURE THE QUALITY OF EACH PRODUCT

公司本着诚信正直,信守承诺,先卖信誉后卖产品,与客户双赢的经营方针,

公司本着诚信正直,信守承诺,先卖信誉后卖产品,与客户双赢的经营方针,

严格把控产品细节,统一管理,专人专责,确保产品交付的每一个细节;

严格把控产品细节,统一管理,专人专责,确保产品交付的每一个细节;

产品齐全,多层板可定制生产

COMPLETE PRODUCTS,PLYWOOD CAN BE CUSTOMIZED

为了制造好的产品,公司秉承着品质保障,诚信为本的理念,从选择实木原材料就严格把关,保障把每一个产品做好。

为了制造好的产品,公司秉承着品质保障,诚信为本的理念,从选择实木原材料就严格把关,保障把每一个产品做好。

实实在在的给客户带来更高的效益。

实实在在的给客户带来更高的效益。

厂家直销,价格质量相对实惠

FACTORY DIRECT SALES, RELATIVELY AFFORDABLE PRICE AND QUALITY

产品集研究、开发、生产和销售于一体,厂家直销,价格质量更实惠。

产品集研究、开发、生产和销售于一体,厂家直销,价格质量更实惠。